In recent years, New Zealand has become a hotspot for global green energy investment with its abundant renewable energy resources and firm commitment to sustainable development. The government has set a goal of achieving 100% renewable electricity by 2035 , providing investors with unprecedented development opportunities. For Chinese investors who want to enter New Zealand’s new energy market, the following are key investment tracks, entry methods, practical steps and risk assessment.

Contact iNZvest for the latest green energy investment opportunities (accepting investment).

Overview of Green Energy in New Zealand

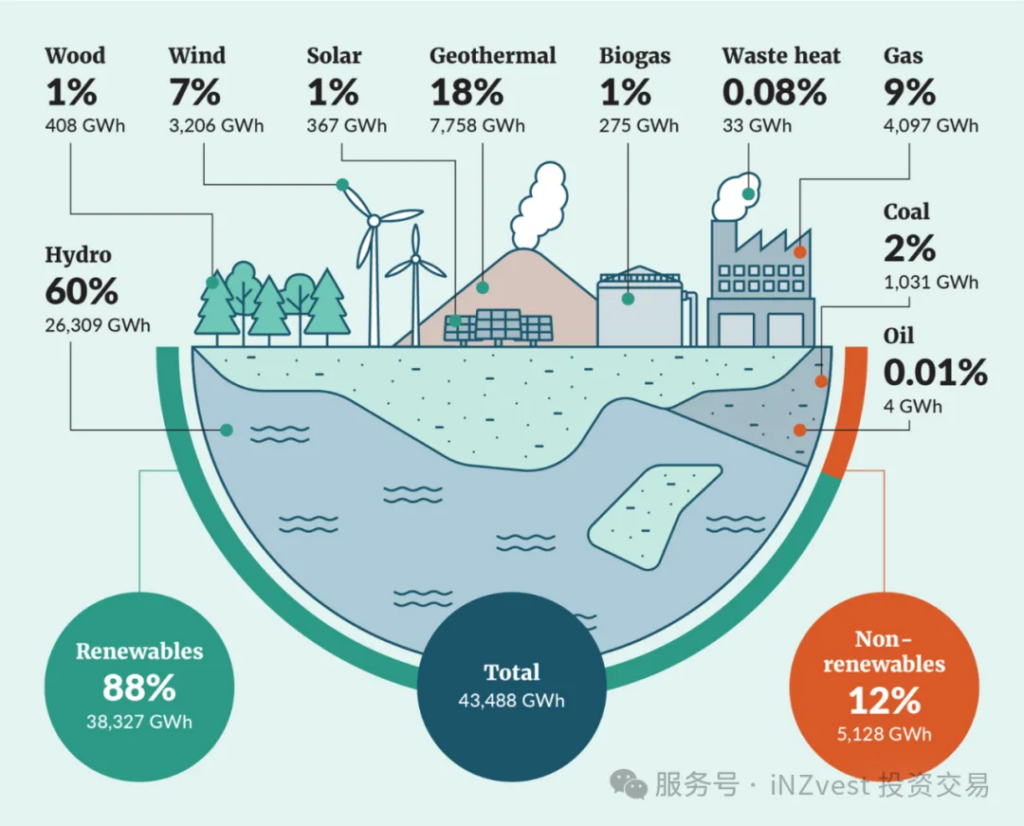

New Zealand’s electricity supply is mainly renewable , accounting for 88% , mainly including:

- Hydropower (accounting for about 60%): Relying on abundant river resources, New Zealand’s hydropower stations have been operating stably for a long time and are the mainstay of the country’s energy supply.

- Geothermal (global leader): New Zealand is one of the world’s major geothermal power generation countries, with mature technology and operational experience.

- Wind power & solar energy (rapid growth): The government is vigorously promoting the development of wind power and solar energy and providing relevant incentive policies.

Figure: 2023, a record year for renewable energy supply. New Zealand’s mix of renewable and non-renewable energy will vary from year to year depending on a number of factors.

Analysis of the five golden tracks

Considering New Zealand’s resource advantages and policy environment, the following five new energy investment tracks deserve special attention:

- Photovoltaic and pastoral symbiosis model (photovoltaic + agriculture) : install photovoltaic panels on pastures/farms, utilize farm land resources, and develop animal husbandry at the same time, creating dual benefits of “selling electricity + selling agricultural products”.

- Household energy storage market : In view of the frequent earthquakes in New Zealand, household energy storage devices (similar to power banks) are promoted to provide low electricity prices at night + emergency backup power functions.

- Offshore wind power + ecological compensation : Build wind farms in the Cook Strait and other waters, and at the same time improve the project approval rate through ecological compensation measures such as bird protection and noise control.

- Hydrogen export : Use the cheap hydropower resources in the South Island to produce “green hydrogen” and export it to energy-deficient countries such as Japan and South Korea.

- Integration of geothermal energy and culture and tourism : Develop power stations in geothermal-rich areas (such as Rotorua) and create hot spring tourist attractions to achieve a win-win situation for energy and tourism.

Figure: Toyota Mirai used in New Zealand’s commercial hydrogen car trials.

How can foreign capital invest in New Zealand’s new energy?

Offshore investors can enter the New Zealand market through the following means:

1. Direct investment in new energy projects

Investors can directly invest in wind power, photovoltaic, geothermal and other projects, choose to cooperate with local developers or acquire existing projects.

2. Joint venture or strategic cooperation

Establish joint ventures with local companies and leverage their familiarity with regulations, markets, and operations to speed up project implementation.

3. Public-Private Partnership (PPP)

The government encourages the public-private partnership (PPP) model to participate in large-scale infrastructure construction, which can enjoy financial incentives and policy support.

4. Green Bonds & Financial Instruments

Investing in green bonds or other renewable energy financial instruments can not only support new energy projects but also obtain long-term stable returns.

Practical steps to invest in new energy

To successfully invest in New Zealand’s new energy market, you need to follow the following steps:

- Market research : Study the market potential of different renewable energy sources in New Zealand and identify investment targets.

- Contact government agencies : Contact New Zealand Trade and Enterprise (NZTE) and Invest New Zealand for official guidance.

- Legal compliance review : Understand New Zealand’s foreign investment regulatory laws and apply for necessary investment approval from the Overseas Investment Office (OIO).

- Apply for government subsidies and incentives : The government provides financial subsidies for new energy projects through the Energy Efficiency and Conservation Authority (EECA), which should be actively sought.

- Find local partners : establish joint ventures or acquire local companies to adapt to the market environment more quickly.

- Technology layout : focus on cutting-edge technologies such as smart grids, energy storage technology, and hydrogen transportation to improve return on investment.

- Risk management : Pay attention to external factors such as exchange rate fluctuations and policy changes, and formulate hedging strategies in advance.

Summary: How to successfully implement new energy investment?

New Zealand’s green energy market provides huge opportunities for offshore investors, but to achieve successful implementation, economic, political and cultural factors must be taken into account.

- Economic level : select high-potential tracks (such as solar-pastoral symbiosis and hydrogen energy export), combine local demand and policy dividends, and ensure project profitability.

- Political level : Comply with New Zealand energy regulations and actively cooperate with government agencies to improve policy adaptability.

- Cultural level : Respect Maori culture, ensure that the project is in line with the interests of the community, and avoid social disputes affecting the investment process.

If investors can seize this round of new energy development opportunities, they will occupy an advantageous position in the global energy transformation.

Contact iNZvest for the latest green energy investment opportunities (accepting investment).