New Zealand’s biotechnology sector has been steadily gaining traction, emerging as a significant player on the global stage. In 2025, the sector presents a compelling opportunity for foreign investors, driven by a combination of innovative research, supportive government policies, and a robust ecosystem of biotech companies. This article provides an overview of the strengths, opportunities, and challenges of investing in New Zealand’s biotech sector.

Overview of New Zealand’s Biotech Sector

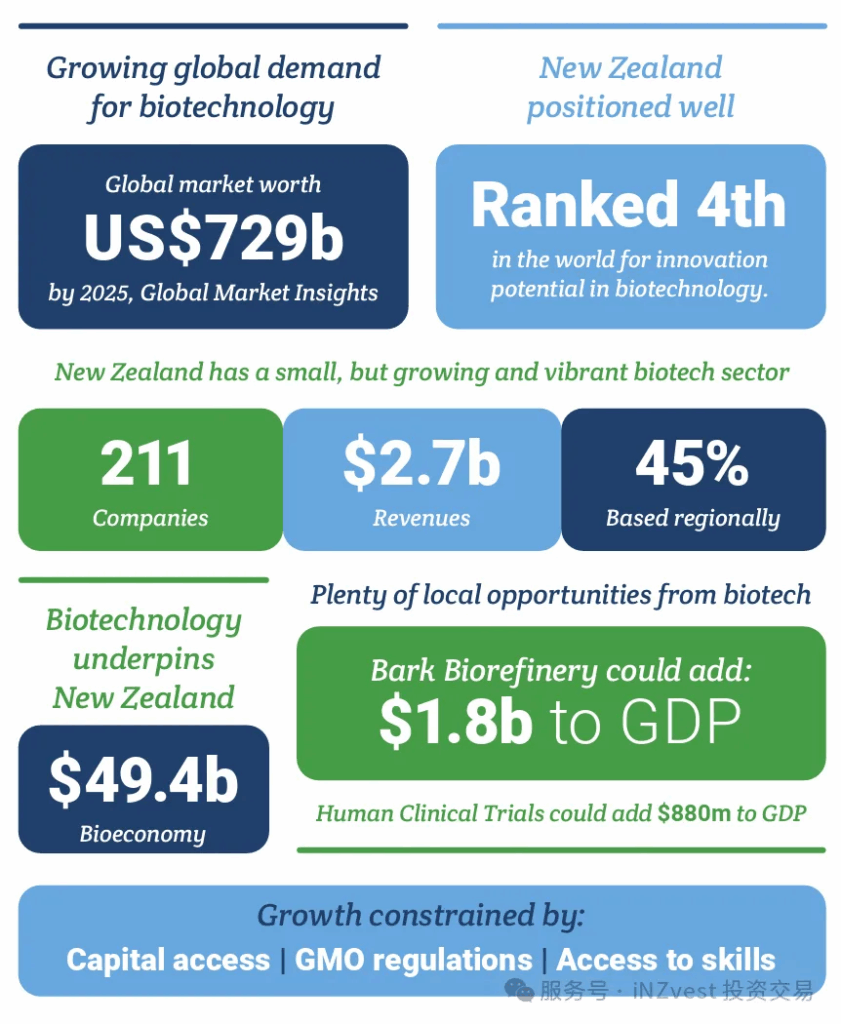

New Zealand’s biotech sector is characterized by a diverse range of companies engaged in various fields, including medical, agricultural, and environmental biotechnology.

Prominent biotech companies in New Zealand include Pacific Edge, Aroa Biosurgery, AFT Pharmaceuticals, Biocell Corporation, and Amaroq Therapeutics.

The country is also home to two of the top global 100 life science and medicine universities, the University of Auckland and the University of Otago, which contribute significantly to research and development in the biotech field.

Key Strengths of New Zealand’s Biotech Sector

Innovative Research and Development

New Zealand’s biotech sector is underpinned by strong research and development capabilities. The country’s universities and research institutions are at the forefront of biotech innovation, producing groundbreaking research that drives the industry forward.

For instance, the University of Auckland and the University of Otago are renowned for their contributions to life sciences and medicine.

Supportive Government Policies

The New Zealand government has implemented several policies to foster the growth of the biotech sector. The Endeavour Fund, for example, aims to support high-impact research that can transform New Zealand’s future.

Additionally, recent changes to the Overseas Investment Act (OIA) are expected to make it easier for foreign investors to acquire New Zealand assets, further boosting investment in the biotech sector.

Strong Industry Collaboration

Collaboration between academia, industry, and government is a hallmark of New Zealand’s biotech sector. Organizations like BioTech New Zealand play a crucial role in fostering these collaborations, promoting innovation, and raising awareness about the benefits of biotechnology.

Events such as the Life Sciences Summit provide a platform for stakeholders to connect, share knowledge, and explore new opportunities.

Opportunities for Foreign Investors

Medical Biotechnology

New Zealand’s medical biotech sector is thriving, with companies developing innovative treatments and diagnostics. Pacific Edge, for example, is known for its cutting-edge cancer diagnostics.

The country’s strong healthcare infrastructure and focus on personalized medicine make it an attractive destination for investment in medical biotechnology.

Agricultural Biotechnology

Agriculture is a cornerstone of New Zealand’s economy, and the integration of biotechnology into this sector offers significant opportunities. Companies like Aroa Biosurgery are leveraging biotech to develop advanced agricultural products and solutions.

Investments in sustainable farming practices and agritech startups can yield substantial returns, given the global demand for sustainable and efficient agricultural solutions.

Environmental Biotechnology

Environmental sustainability is a key focus in New Zealand, and biotech companies are developing innovative solutions to address environmental challenges. From bio-remediation to waste management, there are numerous opportunities for investment in environmental biotechnology. The government’s commitment to sustainability further enhances the attractiveness of this sector.

Why New Zealand?

Global Leader in R&D Innovation: Universities and research institutions (such as the Auckland University Medical Research Centre) are pushing the frontiers of biotechnology, focusing on gene therapy and precision medicine.

Endeavour Fund: Substantial funding for disruptive technology development, with individual project grants of up to 10 million NZD.

Overseas Investment Act Reform: Streamlining foreign investment entry processes, improving the efficiency of biotechnology asset acquisition approvals by 40%.

Ecosystem: BioTech New Zealand: A national industry platform linking over 300 companies with global capital. The Life Sciences Summit: Asia-Pacific flagship industry event, facilitating more than 50 cross-border collaborations annually.

Case Study: A2 Milk established a purebred A2 cow gene bank through SNP genetic testing technology, creating an industry moat with a patent licensing model, addressing the allergenic issues of traditional A1 protein dairy. In 2018, a strategic partnership with Fonterra expanded production capacity, resulting in FY2020 revenues of NZD 1.73 billion (+32.8%), with 45% of performance contributed by the China market. Over the past three years, the stock price compound growth rate exceeded 40%, leading the high-end health dairy sector.

Challenges and Considerations

Funding and Investment

While New Zealand’s biotech sector has made significant strides, funding remains a challenge. Unlike the Australian biotech sector, which receives funding from various sources, New Zealand’s biotech companies often rely on government grants and their networks for funding.

This can limit the growth potential of startups and smaller companies. However, the recent changes to the OIA and government initiatives to promote foreign investment are expected to reduce some of these challenges.

Market Size and Global Reach

New Zealand’s relatively small market size can be a limitation for biotech companies looking to scale. However, the country’s strong trade relationships and reputation for high-quality products provide opportunities for companies to expand globally. Foreign investors can play a crucial role in helping New Zealand biotech companies access international markets and scale their operations.

Regulatory Environment

Navigating the regulatory environment can be complex for foreign investors. The OIA requires foreign investors to obtain consent for certain types of investments, which can be a time-consuming process.

However, the government’s recent directive to streamline the assessment process and promote overseas investment is a positive development.

Investment Opportunity

iNZvest is working with a client seeking funds to expand their Medical Biotechnology company.

The company has developed a disruptive globally scalable digital therapeutic offering poised to redefine healthcare. It consists of a Class 1 medical device targeting pain management and wound recovery.

First capital raise was oversubscribed in 4 weeks. They are now seeking USD1m to meet anticipated demand. Plan to IPO in 2028. For further details, contact iNZvest.

Conclusion

In 2025, New Zealand’s biotechnology industry resembles an ‘innovation gold mine’—filled with original technologies and supported by reliable policy benefits. For overseas investors, this moment presents a strategic window for leveraging technology acquisitions by accessing global markets.